As the Sochi Olympics ended, many eyes turned to the other side of the Black Sea and the threat of war in Ukraine. With each successive turn of good or bad events, our U.S. stock markets1 seem to react in like manner. That begs the question, what impact do wars have on stock markets, and how should an individual react?

To see the impact of war, let’s first examine the most recent war that started on American soil. The impression that many people have is that the recession of the early 2000s started with the terror attacks on September 11, 2001. The reality is that stocks were already on a downward trend when September 11th happened. Yes stocks dropped sharply in the 10 days following that awful event, but once America grasped the reality of the situation, stocks rebounded, recovering the losses directly related to the shock of that event.2

There is a similar pattern for each conflict involving the United States. “In 14 shocks dating (back) to the attack on Pearl Harbor in December 1941, the median one-day decline has been 2.4%. The shocks, which also include the September 11th terror attacks and the 1962 Cuban missile crisis, lasted eight days, with total losses of 7.4%…The market recouped its losses 14 days later.”3

Similar patterns of decline occurred during several Middle Eastern conflicts such as Desert Storm in 1991, the Iraq War in 2003, and the Syrian Conflict in 2011. Leading up to each of these events, the market dropped, but recovery happened shortly thereafter.4

Mark Luschini, the Chief Investment Strategist for Janney Montgomery, put it this way, “It’s not that it’s welcome, but once it gets underway, you can quantify what the situation might look like. When you’re left in the dark about when it will start, what will be the result, it gives investors trepidation.”5

Short-term shocks to the system cause short-term consequences for the stock market and the economy. On the other hand, major periods of conflict can have more lasting effects on the economy and the stock market.

One of the most harmful economic effects of war is a supply shock. A major shock in the supply of goods or labor can severely impact economic productivity. Sources of these setbacks include economic sanctions, manufacturing destruction, infrastructure damage, etc. This has not been a factor of major concern within the United States as it has been a long time since there has been a war fought on American soil.

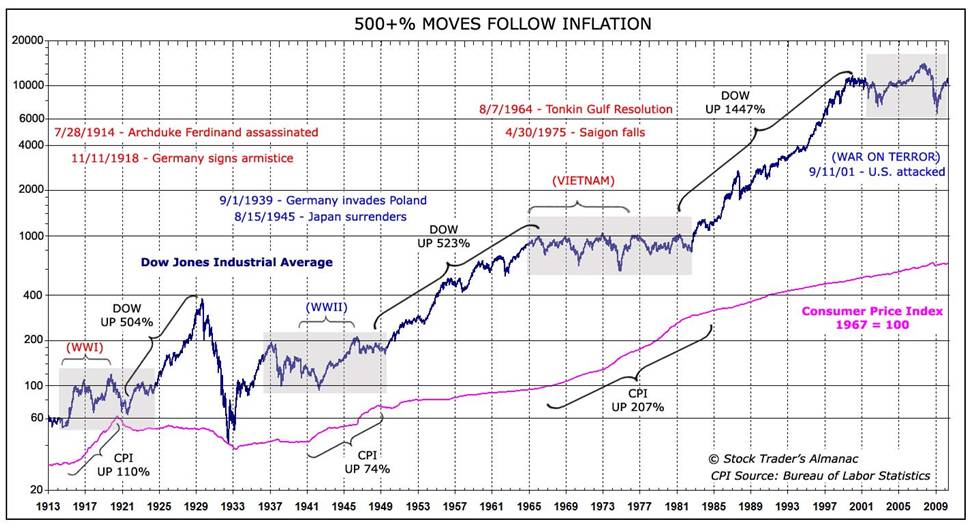

Public opinion supports the belief that war and its associated spending creates positive economic outcomes for the U.S. economy. This is mostly due to the higher GDP growth that was exhibited during conflict periods like World War II, the Korean War, the Vietnam War, and the Cold War. The only outliers have been the Iraq and the Afghanistan wars.6

While war tends to generate some positive economic benefits, it is more of a mixed bag for stock markets. “During WWII stock markets did initially fall but recovered before its end, during the Korean War there were no major corrections while during the Vietnam War and afterwards stock markets remained flat from the end of 1964 until 1982.”7

Another typical impact of major conflicts is inflation. This is due to the increase in government spending through various financing methods. “While inflation may be good for reducing debt burdens, high inflation has many harmful effects, such as wealth redistribution and erosion of international competitiveness.”8

Short-term conflicts typically have a short-lived impact on the stock market. As such they shouldn’t change an individual’s investment philosophy or cause one to “abandon ship.”

A more prolonged conflict may cause an individual to take a more judicious approach by reevaluating his or her goals and making adjustments based on the current market environment. As always, it is prudent to seek advice from an experienced investment professional that can help you plan for and navigate your own voyage through our uncertain world.

Learn more about Smedley Financial.

1. Research by SFS. Please see stock market disclosure at the bottom of page three.

2. Adam Shell, “What Wall Street is Watching in Ukraine Crisis,” USA Today, 3/3/2014

3. Adam Shell, “What Wall Street is Watching in Ukraine Crisis,” USA Today, 3/3/2014

4. Chris Isidore, “Impact of War On Stocks and Oil,” CNN Money, 9/3/2013

5. Chris Isidore, “Impact of War On Stocks and Oil,” CNN Money, 9/3/2013

6. Michael Shank, “Economic Consequences of War on the U.S. Economy,” Institute for Economics & Peace, 2011

7. Michael Shank, “Economic Consequences of War on the U.S. Economy,” Institute for Economics & Peace, 2011

8.Michael Shank, “Economic Consequences of War on the U.S. Economy,” Institute for Economics & Peace, 2011

One Comment