Companies often give Restricted Stock Units (RSUs) to their employees as compensation for hard work and to retain talent. RSUs are a promise of actual company stock, as opposed to stock options, which are just the option to buy the stock at a future date and have no intrinsic value. The significant RSU restriction is that you aren’t vested until a future date, typically over four years. If you leave the company, the company will retain the unvested shares. The main question is should you sell your RSUs immediately as each segment (or tranche) vests or should you hold on to the shares?

Companies often give Restricted Stock Units (RSUs) to their employees as compensation for hard work and to retain talent. RSUs are a promise of actual company stock, as opposed to stock options, which are just the option to buy the stock at a future date and have no intrinsic value. The significant RSU restriction is that you aren’t vested until a future date, typically over four years. If you leave the company, the company will retain the unvested shares. The main question is should you sell your RSUs immediately as each segment (or tranche) vests or should you hold on to the shares?

As with all planning, you should look at this as a piece of your financial puzzle, which includes short-term, intermediate, and long-term goals.

On the vesting date, the restricted stock units are converted into actual shares. You don’t pay anything. However, the conversion creates a taxable event and your income for the year will be increased by the value of the shares – REGARDLESS OF WHETHER YOU SELL THEM OR NOT.

Let’s say Sally works for XYZ company making $100k. She is given $200k in RSUs vesting over four years. This year, $50k in RSUs are available. When the RSUs are converted, her Adjusted Gross Income (AGI) will be increased by $50k, making her total AGI $150k. Sally may have to pay around $14k more in taxes. (Tax will vary depending on many factors: marital status, spousal income, deductions, etc.). If Sally doesn’t have the $14k in the bank, how will she pay the extra taxes?

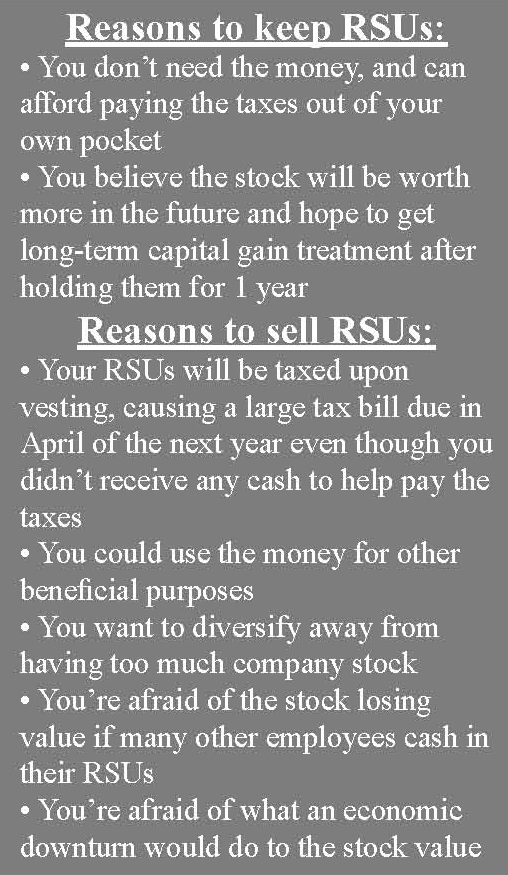

In many cases, employees end up selling their RSUs to pay the taxes unless the company’s plan allows some shares to be sold to pay the taxes. As a rule of thumb, an individual shouldn’t have more than 20 percent in their company stock. So, even if employees can sell shares to pay the taxes, you may still want to sell your vested shares. Selling allows you to diversify away from having too much in one investment. You may also sell to use the proceeds for other beneficial purposes, like building an emergency fund, funding your children’s education, or paying down your mortgage.

When the first block of RSUs becomes available, there is typically some downward pressure on the stock price. A growing company can overcome this, but it is also a question of how long you are willing to wait.

If you hold the shares for longer than one year from the vesting date, your growth will qualify for long-term capital gains rates. So, if an RSU was given to you at $20 per share and after one year you sell at $25 per share, you will pay tax on the $5 in growth at the long-term capital gains rate. The risk in waiting is the stock price could go down.

Deciding to sell or hold your shares depends on a myriad of factors including taxes, diversification, company performance, market conditions, and the purpose of the money. Your decision should be based on your overall financial plan that includes short-term, intermediate, and long-term goals. If you need help creating your financial plan or even if you have questions about how to handle Restricted Stock Units, please contact one of our Wealth Managers that can help you navigate the waters of life.

*SFS and its representatives do not provide tax advice; it is important to coordinate with your tax advisor regarding your specific situation.