When Lehman Brothers collapsed in 2008, all lending essential stopped. The U.S. Federal Reserve (Fed) feared that all five investment banks in this country would cease to exist. No one fully understood the financial calamity coming, but we were beginning to feel what the worst recession in 80 years would be like.

The Fed acted to stop the financial infrastructure from imploding. It believed cushioning the blow was necessary to help all Americans. It started the Troubled Asset Relief Program (TARP). It added to that program over the years with Quantitative Easing (QE) one, two, and three.

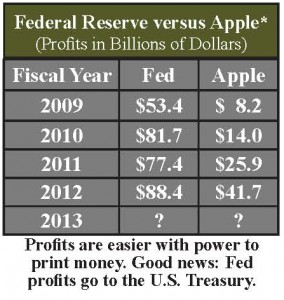

Recent years may not have felt like easy money to us, but there is likely no organization more profitable in recent years than the Fed.

The Fed doesn’t literally print money (a responsibility of the U.S. Treasury). It doesn’t have to. Money is created electronically by the Fed and infused into the financial system through open market actions. Its effectiveness is questionable. Its impact is global. And at some time soon it may be ending.

What Is the Fed’s Impact?

Currently, the Fed is spending roughly $85 billion each month to buy treasury bonds in order to keep long term interest rates at historically low levels. The goal is to encourage risk taking. The Fed wants banks to lend, businesses to hire, and consumers to borrow.

If you have purchased a home, refinanced a loan, or bought a car with debt, then you have benefited from these unprecedented efforts of the Fed.

All this money the Fed is creating seems to be working to a small degree. The U.S. stock market* is on track for its fourth positive year in the last five. If you have invested in stocks or bonds consistently during this time, you have probably benefited from the Fed’s actions. Experts have been debating how well the Fed’s historic efforts have worked. One theory is that each time the Fed spends, it has less positive impact than the previous effort. This would explain the lackluster growth in the economy.

Why Is the Fed Still Involved?

Simply stated, the benefits still appear to outweigh the risks.

Low interest rates are meant to be enablers for businesses and consumers to increase borrowing. If the debt gets out of hand, then we will be facing similar problems to those that got us into this mess.

If spending and demand increase too much, then inflation could rise to levels considered too high for a developed economy (greater than 4 percent). At that point, the Fed will have to react to try to slow down the economy even if it means job losses.

At this point, official inflation is tame and private debt levels do not appear inflated like in 2007.

As long as the risks appear low and unemployment is above 7 percent, the Fed is likely to keep spending.

What Will Happen When the Fed Slows Stimulus?

Interest rates will rise from the unusual levels where they currently are to a more natural rate determined by investors. We experienced a taste of what this will feel like this spring and summer. Rates on the 10 year treasury almost doubled in just a few months. Investors saw an increase in volatility.

Where Is the Silver Lining?

Don’t fight the Fed is a common phrase for investors. The Fed is powerful and it is working for what it believes is best for Americans. It plans to cut stimulus only after it determines that the U.S. economy is strong. If rates rise that should bring better yields for savers.