One of the most common questions I get asked by retirees is, “Am I going to be okay?” Whether it is the first or last question, it is the most important. People want to know, “Will my retirement last?”

Risks to retirees are significant, and some have always been around while others are becoming more and more relevant.

The effects of bear markets, consequential portfolio losses, and inflation have always been something we combat. In addition, the sequence of return risk and the timing of retirement are more critical than ever.

There are ways to measure and tactics to help mitigate these risks.

Bear Markets

Most people describe a bear market as greater than 20% from the most recent high or simply the prolonged decline in prices and struggle of the market or economy. It can also coincide with investor fear and pessimism. The worst thing about a bear market is not necessarily the drop in prices but how long it can last.

A few studies looking back to the late 1800s and early 1900s have shown that the average duration of a bull market is 11 years. Once a bear market begins, it takes 19 years to go down and come back up to the previous high. Since 1929, investors have lost an average of 39.1% during bear markets. Some of the worst ones include the 80% loss of the Great Depression and the approximate 50% losses of the Dot Com Bubble and the Great Recession. The way markets cycle up and down; we are bound to have several during our retirement.

Sequence of Returns

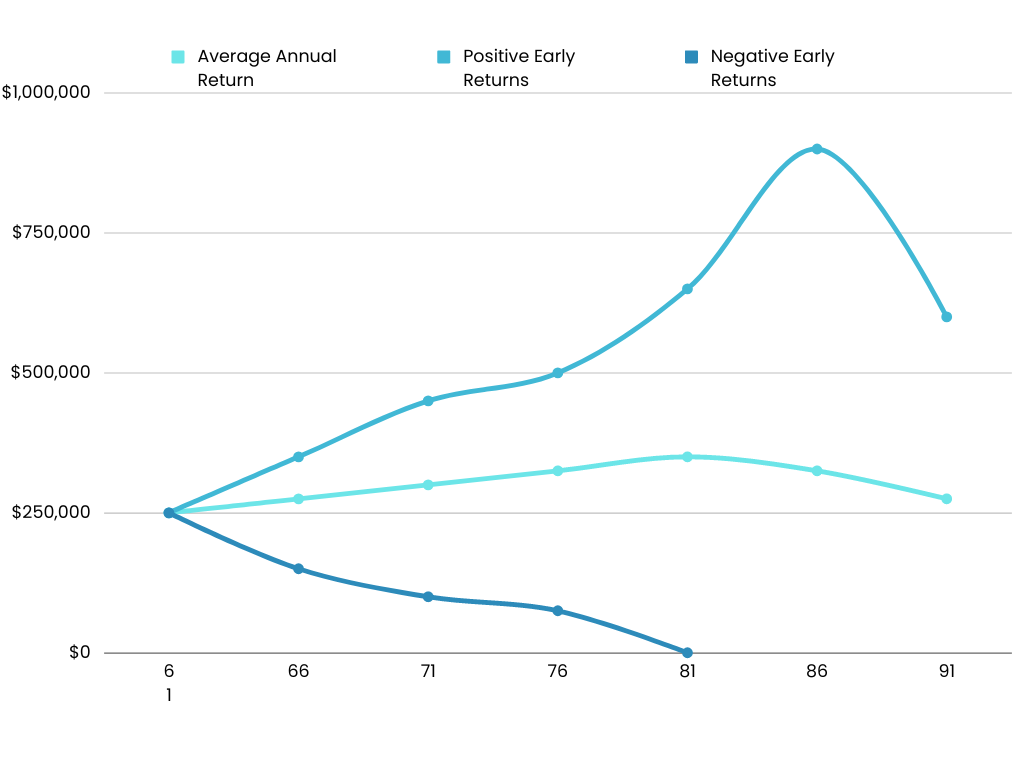

Another risk you have probably heard of by now is the sequence of returns risk. This is best described as the consecutive returns one gets while taking distributions in retirement. Specifically, it is the potential for big losses in the early years of retirement. Having significant, negative losses in those formidable years can drastically affect how long your money lasts. Look at the graph that depicts the different scenarios below.

This assumes the same $250,000 and the same average 7% annual return over the retiree’s life. You can see that if the same dollar amount is subject to early negative years in the market, you can run out of money sooner than you would like.

More risks like these lead us to create strategies to combat downside risk and volatility. We do everything we do here at Smedley Financial to ensure you do not run out of money by creating portfolios that do not sway as much with the market, implementing Lifetime Income Planning, and actively managing investments. Please watch the following newsletter as we will explore additional risks for retirees and the science behind how to overcome them.

Listen to a deep dive on the Power Up Wealth podcast by clicking here.