The 8.7% increase in Social Security benefits could create excess money for some retirees in 2023. An individual with a $2,500 monthly benefit can expect an increase of $217.50. That’s an additional $2,610 annually. Make that excess count!

Building emergency savings provides a first line of defense, especially as inflation pushes costs up for necessities and services. Over the past couple of years, there has been a rise in consumer debt. This is a great time to pay down debt, especially debt tied to increasing variable rates.

There are also ways to manage your tax liabilities. Look at distributions from retirement accounts, such as IRAs. These distributions, combined with income from pensions and Social Security, may increase the tax basis of your Social Security benefits, causing you to pay taxes on a greater portion of your Social Security income. If your IRA distributions are more than you need, consider reducing the amount of the distribution. If you are at required minimum distribution age, implement strategies to help reduce your tax burden, such as making Qualified Charitable Distributions (QCD). This allows money to go from your IRA directly to a qualified charity of your choice. You do not pay taxes on the distribution, the distribution does not count as income (not included in IRRMA calculation), and the charity receives the benefit of the full donation.

Working between the age of 62 and full retirement age (FRA) comes with caveats regarding Social Security. If you receive Social Security benefits at age 62 and have earned income of more than $21,240, Social Security will take back $1 of every $2 dollars you earn over the earnings limit. If you reach FRA in 2023, the limit on your earnings for the months before your FRA is $56,520. If you earn more than $4,710 per month, Social Security will withhold $1 for every $3 earned over the limit.

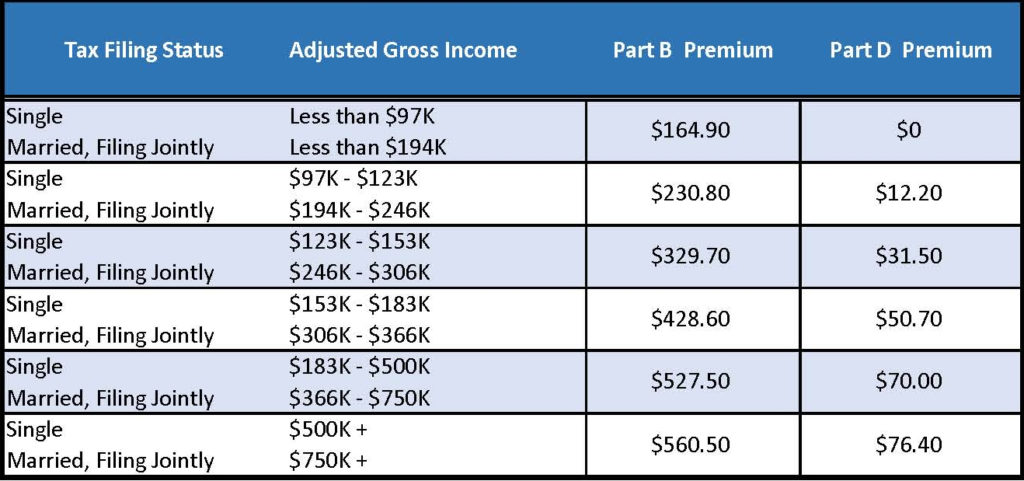

Social Security and Medicare go hand in hand. Retirees paying Medicare Part B and Part D premiums will also see some relief. Medicare income-related adjustment amounts, or IRRMAs, may be smaller for high-income earners in 2023. The premium adjustment kicks in at a modified adjusted gross income of $97,000 for single tax filers and $194,000 for joint filers; this is increased from 2022. A two-year look back at tax returns determines if you will pay an extra premium charge. In addition to the increased brackets, premiums will be dropping by 3%. Tax filers falling below the IRRMA limit will see Part B premiums at $164.90, down from the 2022 premium of $170.10. See the chart for the 2023 IRRMA adjustment limits and premiums.

The bottom line – implementing planning strategies can help reduce tax burdens for 2023. Reach out to one of our Private Wealth Managers to discuss your specific situation.