Lifetime Income Planning

Will you have enough income when you retire?

The goal of a Lifetime Income Plan is to assure that your income sources and nest egg are directed to help you maintain a comfortable lifestyle throughout your retirement years. It addresses the question, "Will your money last as long as you?"

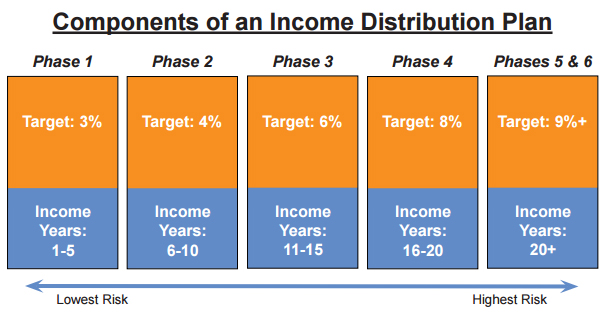

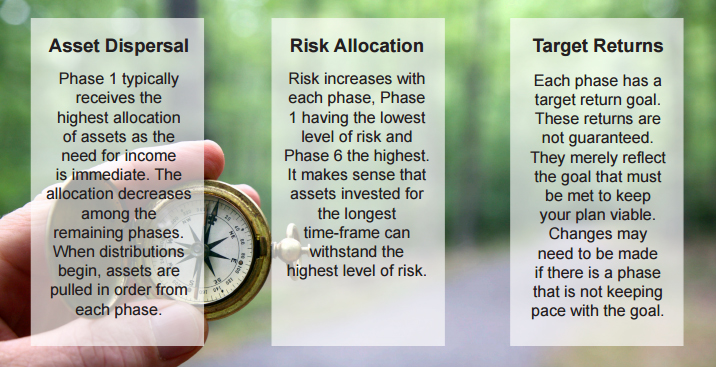

Segmenting assets to provide income during specific time horizons is the basis of Lifetime Income Planning. The goal is to provide an income distribution level that will keep pace with inflation and will continue throughout retirement. Each income producing phase is invested based on a specific group of factors and criteria. This strategy has the potential to increase the income you will receive throughout your lifetime.

By varying the risk and investment time-frame for each phase, you can feel confident that a plan has been structured to help manage the emotional side of investing while still combating potential pitfalls like inflation. This will help protect your short-term income and keep your long-term investments on target for the future.

Navigating retirement requires planning in advance to reach your destination. A Lifetime Income Plan, focused on your specific income needs, will help you address the many issues that await you as you transition into this exciting stage of life.

Want to learn even more about Lifetime Income planning. Contact Us

+ Next: Learn Aboout Our Active Approach to Investment Management

LIFETIME INCOME PLANNING DISCLOSURES

Investing involves risks. Stock and bond values fluctuate in price so that the value of an investment can go up or down depending on market conditions. Stock prices may fluctuate due to stock market volatility and market cycles, as well as circumstances specific to a company. Fixed income investing is subject to interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. Investments in high-yield bonds carry increased credit risk due to the low credit rating of the issuing company. Investments in foreign markets entail special risks such as currency fluctuations, political developments, economic and market instability. Investing in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets' smaller size and lesser liquidity. Long/short investment strategies utilize short selling, which involves selling a security not owned in anticipation that the security's price will decline. This strategy could result in losses if the value of the securities held long decrease and the value of the securities sold short increase.

Investments in mortgage-backed bonds, such as FNMA (Fannie Mae) and GNMA (Ginnie Mae) are also subject to "pre-payment" risk, which is the chance that during periods of falling interest rates, homeowners will refinance their mortgages before their maturity dates, resulting in prepayment of mortgage securities held by the fund. The fund would then lose potential price appreciation and would be forced to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the fund's income.

The principal value of inflation-adjusted bonds are linked to the Consumer Price Index (CPI) and adjusted every six months to reflect the effects of inflation. If the CPI inches up 2.5% over the course of the year, the principal value of a the bond is adjusted upward by 2.5% and the fixed rate of interest is applied to the inflation-adjusted principal. However, if deflation should occur, your principal would go down the same percentage. At maturity the owner is paid at least the original face value. This protects you from deflation from issuance through maturity, though not from price fluctuations prior to maturity

Annuities are long-term investments designed for retirement purposes. Withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 1/2, a 10% federal tax penalty may apply. Early withdrawals may be subject to withdrawal charges. Optional riders are available at an additional cost. All guarantees are based on the claims paying ability of the insurer. An annuity is a tax-deferred investment. Holding an annuity in an IRA or other qualified account offers no additional tax benefit. Therefore, an annuity should be used to fund an IRA or qualified plan for annuity features other than tax deferral.

If a fixed indexed annuity is terminated prior to the end of the surrender period, there is a possibility of loss of principal. Guaranteed account values apply only if the annuity is held to term. Caps, spreads, and or participation rates may change annually. The decision to purchase income annuities to fund your retirement needs now, or in the future, may change based on your review of your investment strategy, the return of your investments, and your individual needs. Your income annuity purchase may be irrevocable after the initial free-look period. You should consult your tax and financial advisors when purchasing or selling any investment.

Single Premium Immediate Annuity contracts cannot be surrendered once annuitized.

Structured products typically pay an interest or coupon rate above prevailing market rates and limit upside participation in the referenced asset if principal protection is offered or if the security pays an above-market interest rate. Risks may include loss of principal and the possibility that at expiration the investor will own the referenced asset at a depressed price. Other factors that may affect the investment value of the structured product include; interest rates, volatility of the underlying asset, liquidity and time remaining until maturity. Structured investments are generally backed by the issuing firm which may or may not maintain a secondary market.

Investments in Real Estate Investment Trusts (REITs) and REIT funds are subject to the inherent risks of direct investment in real estate such as price fluctuation, liquidity, and concentration risks. Special risks associated with investing in real estate also include the possibility of declining real estate values, the possible lack of availability of mortgage funds, and changes in interest rates.

Precious metals are subject to unique risks and costs, such as cost associated with the storage of the physical commodity. As many precious metals are designed as a counter to inflation, they are likely to perform poorly in advancing markets. Precious metals are also subject to illiquidity risks as there may be no secondary markets to buy and sell the commodities. Additionally, the commodities/precious metals markets have historically been very volatile as precious metals are subject to greater fluctuations in price and as such are not suitable for all investors.

An investment in managed futures involves a high degree of risk, is speculative and volatile. An investor could lose all or a substantial part of his or her investment. There is no guarantee that an investment of this type will achieve its objectives. Managed futures funds' high fees and expenses offset trading profits and reduce returns. Managed futures investments involve the use of significant leverage that may increase the risk of investment loss. The interests of investors in managed futures funds may conflict with your own. Managed futures are not subject to the same regulatory requirements as mutual funds. An investment in managed futures funds is illiquid. There is no secondary market for managed futures funds, and there are restrictions on transfer of managed futures funds. A substantial portion of the trades executed with respect to managed futures investments may take place on foreign exchanges.